CHAIRMAN’S MESSAGE

His Excellency Sheikh

Nahayan Mabarak Al

Nahayan

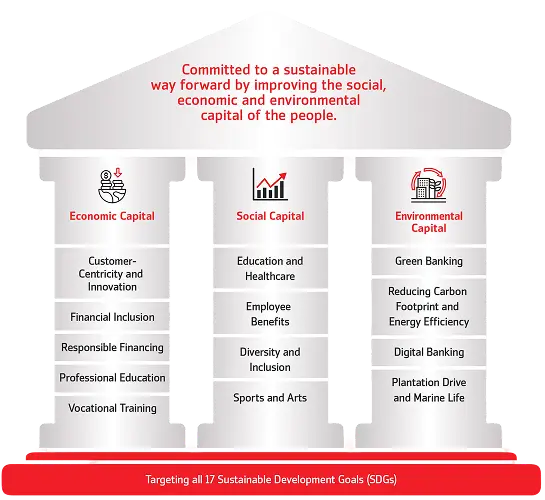

Sustainability

The Bank’s enduring commitment to foster a sustainable future, we have undertaken a series of initiatives designed to enhance our community’s social, economic, and environmental capital in an eco-friendly manner. Building upon this foundation, and as part of our strategic approach to sustainable banking practices, the Bank partnered with the International Finance Corporation (IFC) to collaborate on the development of green strategies. This partnership serves as a testament to our goal of providing environmentally friendly banking operations. The partnership covers The Bank’s enduring commitment to foster a sustainable future, we have undertaken a series of initiatives designed to enhance our community’s social, economic, and environmental capital in an eco-friendly manner. Building upon this foundation, and as part of our strategic approach to sustainable banking practices, the Bank partnered with the International Finance Corporation (IFC) to collaborate on the development of green strategies. This partnership serves as a testament to our goal of providing environmentally friendly banking operations. The partnership covers a multifaceted approach aimed at enhancing our green banking initiatives. It encompasses a comprehensive diagnostic assessment conducted by the IFC to evaluate the green banking portfolio of the Bank. Furthermore, this collaboration will facilitate the exploration and capitalisation of opportunities in green finance, such as the issuance of green bonds and the financing of sustainable infrastructure projects.

President & CEO's message

Atif Bajwa

We have set our sights on the road ahead, focusing on sustainable business operations and holistic corporate social responsibility to create an inclusive future. The website presents our sustainability strategy and partnerships, which have translated into social impact, environmental stewardship, and added economic value.

Pillars of Sustainability

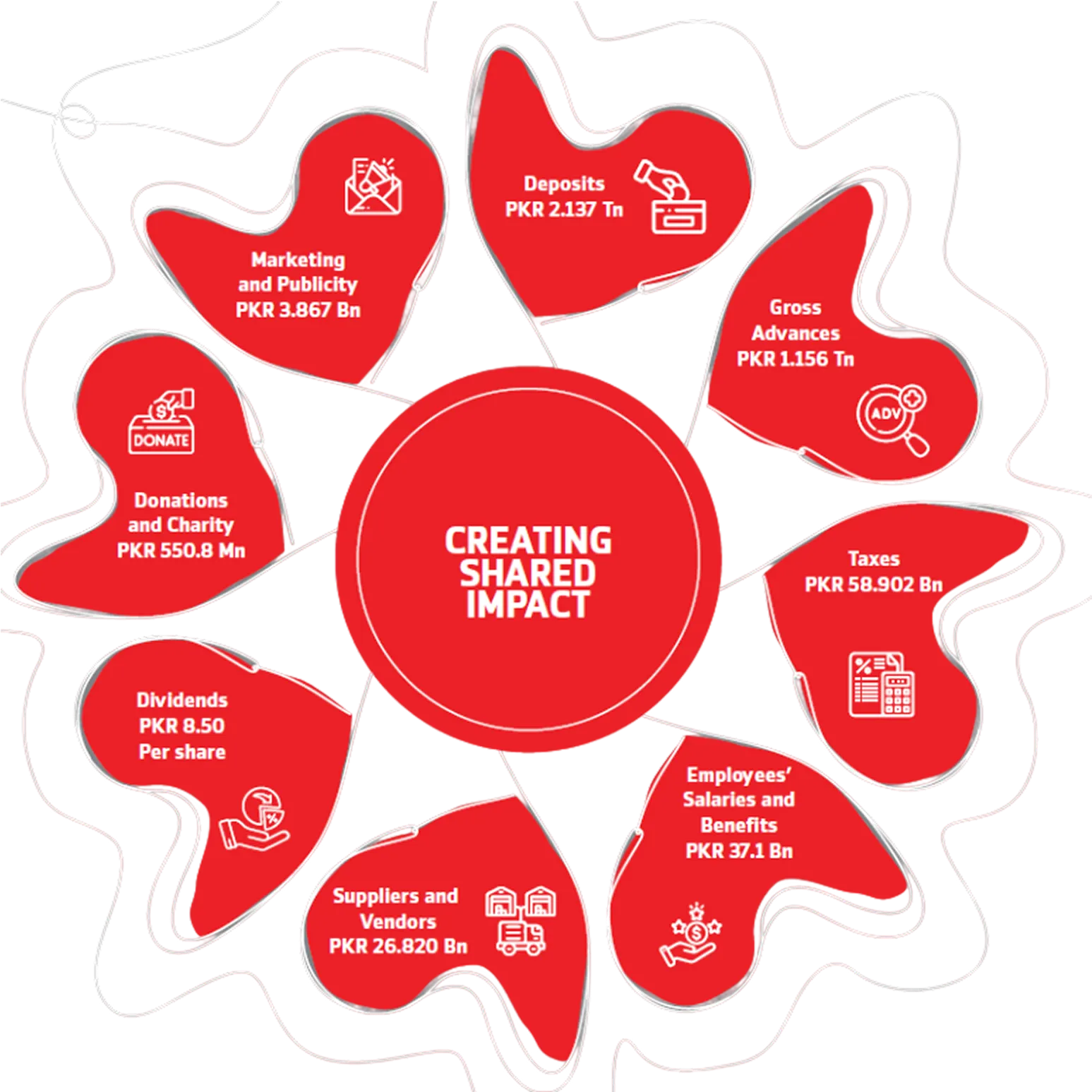

Creating Shared Impact 2024

Advancing Global Goals

During the year, we deepened our alignment with the UN Sustainable Development

Goals (SDGs) and internationally recognised sustainability framework. This

approach ensures that as our footprint consistently expands, our policies and

performance metrics become measurable and continue to improve as we evolve.

Our advisory engagement with the International Finance Corporation (IFC) has

progressed from concept to roadmap. Building on the State Bank of Pakistan’s

Environmental and Social Risk Management (ESRM) framework, already been

implemented at Bank Alfalah.

Read Our Sustainability Reports

Path To Sustainability

Started reporting on sustainability in the annual report.

State Bank Pakistan (SBP) introduced Green Banking guidelines in 2017.

The first Green Banking Policy was approved by the Bank.

Engaged IFC for diagnostic advisory on Green Business facilitations.

- Launched First Sustainability Report.

- Won merit award from ICAP on Sustainability Reporting.

- SBP issued its Environmental and Social Risk Management (ESRM) implementation manual.

- Adopts State Bank of Pakistan’s (SBP) Environmental and Social Risk Management (ESRM) framework.

- Bank Alfalah will work with IFC to develop a green banking roadmap and its impact measurement capabilities and explore avenues for sustainable financing.

- Worked with IFC for internal capacity building for carrying out E&S due diligence of high‑risk projects through an external consultant.

- Revamp the policy of aligning business operations and CSR with Sustainable Development Goals.

- Launched Second Sustainability Report.

- The Bank presented the sustainability report using the Global Reporting Initiative as guidance.

- The Head Office has been recognised as a Green Office by WWF.

- Initiated projects that are aligned with all 17 UN SDGs.

- Launched the third Sustainability Report.

Impact Metrics of 2024

GREEN BANKING- THE WAY FORWARD

Green banking is of paramount importance in today's world as it plays a vital role in promoting environmental sustainability and combating climate change. By integrating environmental and social considerations into banking practices, green banking encourages the adoption of environmentally friendly policies and initiatives.

This approach not only benefits the environment but also contributes to the long-term financial stability of banks by mitigating environmental risks and promoting responsible lending practices. Additionally, green banking fosters innovation by supporting the development and financing of renewable energy projects, energy-efficient technologies, and sustainable businesses. Moreover, it enhances Banks' reputation and brand value, as customers increasingly prioritise sustainability and seek out financial institutions that demonstrate a commitment to environmental responsibility. Ultimately, embracing green banking is essential for building a more sustainable and resilient economy that meets the needs of present and future generations.

GREEN BANKING INITIATIVES

Bank Alfalah’s commitment to betterment in growing environmental and social issues was reflected as early as 2015 when it introduced the Environmental and Social Management Framework for integration in its credit approval process. Later in August 2018, Bank Alfalah formally embarked upon its journey of Green Banking when its Board of Directors approved its first Green Banking Policy and formulated the Green Banking Office in the Bank, aligning with the SBP’s Green Banking Guidelines 2017. This Policy now outlines an enhanced commitment of Bank Alfalah to contribute towards betterment in environmental and social issues through the above-mentioned strategy:

Environmental & Social Risk Management

Continuing with the integration of Sustainable Finance in its lending operations.

Green Business Facilitation

Allocation of funding and resources to businesses that reduce their carbon footprint, become resource‑efficient, and use other means to reduce environmental impact.

Own Impact Reduction

Reducing the Bank’s carbon footprint via renewable energy, lower paper and water consumption, and operational rationalisation.